Britain’s Conservative party’s election win has buoyed smaller companies. The vote of confidence offers an opportunity to take a closer look at UK small- and mid-cap (SMID) stocks, which are highly profitable versus European peers.

UK SMID stocks have rallied since the May 7 elections. From the day before the polls through May 13, the MSCI UK SMID Cap Index has advanced 2.7%, while large-caps declined by 0.3%. And small and mid-sized British stocks have also outperformed their continental European peers by a wide margin of 4.2 percentage points when translated into euros for the same period.

The short-term post-election boost makes sense. In our view, the Conservative victory has lowered the risk premium for owning smaller stocks. It was widely believed that other election outcomes would have led to a less business friendly approach, a wider budget deficit and a possible sell-off of the British pound. The decisive election of a Tory-majority government has provided a dose of stability and continuity that markets crave.

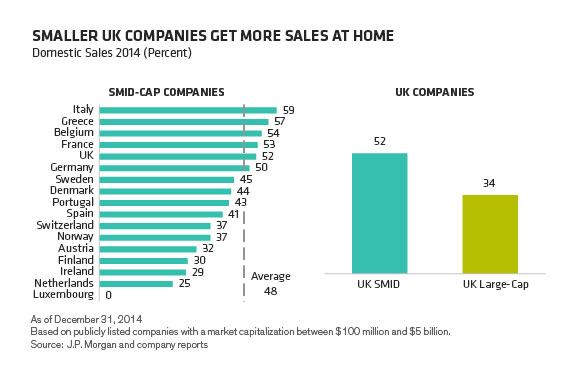

Domestic Sales Matter More

Good news for the domestic economy is often helpful for smaller companies. In many countries, SMID companies tend to derive a greater portion of revenue from domestic business. In the UK, domestic sales account for about 52% of SMID-cap revenues, above the European average of 48% (Display). That’s also much higher than UK large-cap companies, which only generate about 34% of sales in their home market.

Economic resilience helps, too. UK unemployment has fallen to 5.6% in February, the lowest level in nearly seven years, according to the Office for National Statistics. Year-on-year retail sales increased by 4.2% in March. And the pound has strengthened considerably since the election. Although the new government must grapple with significant fiscal issues, we think the economic environment is broadly supportive for smaller stocks.

Yet investing in SMID stocks is more than just a bet on economic growth. In fact, we believe that the UK market is a hotbed of quality, SMID-cap companies. And many complement the domestic exposure with international growth opportunities. Examples range from the world’s second-largest operator of visitor attractions to a world-leading manufacturer of sophisticated tools and sensors that should benefit from the secular growth of industrial automation.

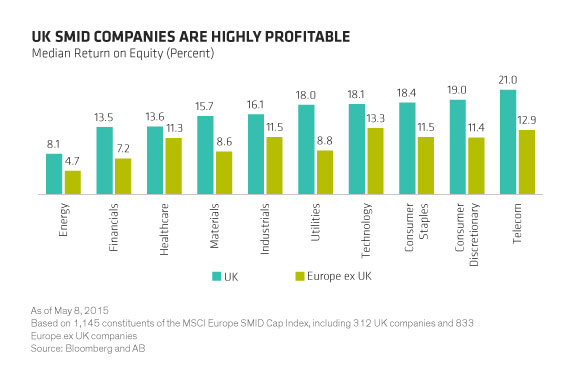

Higher Profitability Across Sectors

Profitability is impressive. SMID-cap UK companies boast higher median profitability than all other European markets except Sweden and Ireland. It’s not just because of a preferential sector mix. In fact, smaller UK stocks have substantially higher return on equity (ROE) than their European peers in every sector of the MSCI Europe SMID Cap Index (Display). In other words, the UK market is an attractive opportunity set for investors seeking international diversification in a SMID portfolio.

Now, as pre-election concerns fade, it’s a great time to take a closer look at the fundamentals of smaller UK stocks. With above-average profitability as a key attraction, we believe investors can find many British companies that benefit from individual business drivers to create a high-conviction cluster of UK SMID holdings within a pan-European allocation to smaller stocks.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. AllianceBernstein Limited is authorized and regulated by the Financial Conduct Authority in the UK.